From Argentina’s rising tanker footprint to the political undercurrents of the EU–US deal, this week’s shifts in liquid trade, energy security, and development policy are redefining freight exposure.

After months of posturing, tariffs, and retaliatory threats, Washington and Brussels have struck a deal. On the surface, it’s a truce—15% baseline tariffs, ramped-up European imports of U.S. energy and arms, and a momentary easing of tensions. But for freight markets, the implications run deeper. The agreement marks more than a diplomatic milestone; it’s already altering trade flows, shifting fleet allocation, and recalibrating ton-mile exposure across the Atlantic.

As energy markets react to trade optimism and lingering Middle East volatility, tankers reroute, bunker prices adjust, and charterers find themselves navigating the early contours of a new normal. Add to that the sharp rise in Argentine crude exports and a sobering UNCTAD report on global commodity dependence, and the picture becomes clear: freight strategy is no longer just a matter of rates—it’s a matter of resilience.

Wet Bulk | Atlantic Push, Diesel Pull, and the Weight of Sanctions

In the aftermath of the EU–US trade agreement, tankers are already shifting course. European refiners are stepping up diesel imports from the U.S. Gulf and, notably, Saudi Arabia—where a super-VLCC loaded with 2 million barrels of diesel is now en route to Europe—underscoring how longer-haul clean product trades are accelerating in response to refining gaps and seasonal demand spikes. The move highlights how geopolitical realignment is unlocking longer-haul clean product trades at a moment when inventories are thin and fuel demand is climbing.

At the same time, Rigzone reports that oil prices slipped last week, with Brent falling from $87.80 to $84.92 per barrel, pressured by a stronger dollar and skepticism around the longevity of trade optimism. WTI followed suit, retreating from $84.23 to $81.39, despite tight inventories and steady demand from key Asian buyers. Yet the fundamentals are hardly bearish: stockpiles remain tight, OPEC+ supply discipline is holding, and Chinese buying continues to underpin demand despite broader uncertainty.

Meanwhile, Argentina’s shale revival is having ripple effects across the tanker landscape. The country’s crude exports—formerly limited to Panamax and Aframax ranges—are now inching into Suezmax territory, with potential VLCC export capability by 2026. Longer hauls from South America to Asia and Europe are set to expand ton-mile demand, especially as infrastructure at Punta Colorada advances.

And in the background, China’s LPG imports remain steady, with the U.S. still the largest supplier. But shifts are underway. Iran and the Middle East are increasing their share, and any escalation in regional tensions could reconfigure route planning for VLGC operators reliant on predictable straits and chokepoints.

Charterer Lens – Wet Bulk

- Atlantic arbitrage opens up: Monitor U.S. Gulf to Europe diesel spreads; clean product tonnage may tighten.

- Argentine export surge: Expect increasing Suezmax demand in South America; plan for longer ballast legs and tighter spot availability.

- LPG exposure in flux: Consider diversification strategies as China shifts sourcing; Middle East risk premiums may rise.

- Volatility still priced in: Rates may not reflect softer crude benchmarks; keep an eye on OPEC+ signals vs market psychology.

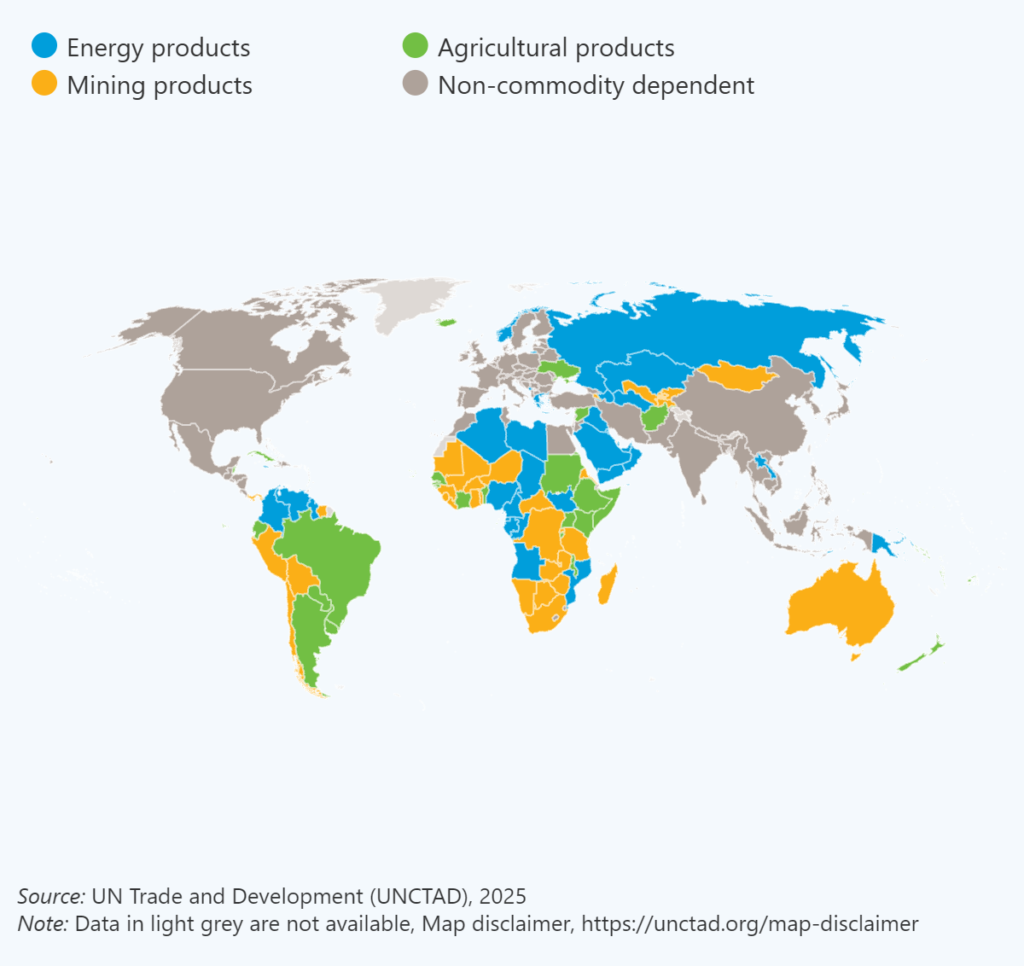

Special Focus | UNCTAD’s Commodity Warning and the Chartering Reality

UNCTAD’s latest report delivers a stark message: 95 of 143 developing economies remain structurally dependent on commodity exports. For those involved in chartering, UNCTAD’s warning translates directly into operational exposure across key export corridors. Charterers moving bulk liquids, fuels, or agri-products out of the Global South are navigating not just trade routes, but systemic vulnerabilities.

When producers rely on raw exports to balance national accounts, any price fluctuation becomes a political crisis. This leads to erratic policies, short-notice export bans, or subsidized shipping programs—all of which distort chartering patterns. Add underinvestment in value-added infrastructure, and the result is a continued reliance on outdated port systems, slower turnaround times, and limited backhaul opportunities.

For charterers, this deep-rooted dependence means operating in an environment of volatility masquerading as normalcy. Rate exposure remains a concern, but the deeper threat lies in service consistency, contract enforceability, and on-the-ground reliability.

Charterer lens:

- Prepare for fragility: Export bans or sudden regulatory shifts are more likely in commodity-dependent countries—build flexibility into contracts.

- Factor infrastructure into turnaround time: Avoid assuming global averages; port performance varies widely in these markets.

- Backhaul scarcity: Don’t expect return cargoes; optimize ballast planning in structurally one-directional trade lanes.

- Engage upstream visibility tools: Better data on political risk, subsidies, or trade interventions can help secure freight exposure before volatility hits.

Conclusion

The headlines may declare peace, but charterers know better: freight markets are made in the fine print. The EU–US deal may ease transatlantic trade tensions, but it also cements a reallocation of routes, refines the balance of tanker demand, and exposes new pressure points in global supply. Argentina’s tanker expansion, China’s shifting LPG preferences, and the entrenched dependence highlighted by UNCTAD all signal one thing—resilience, not reactivity, must define how charterers approach the second half of 2025.

Until next week,

— The Voyager Team

Before You Go…

CHECK OUT OUR NEW TOOL!

Explore our updated Port Turnaround Insights—a free tool to benchmark time in port by vessel type, cargo, and season. It’s just a snapshot of the data our clients use to improve planning and reduce demurrage exposure.

GET OUR LATEST PLAYBOOK

Download our latest eBook, The Steps Behind Managing a Demurrage Claim, and learn how to review claims more effectively, reduce error rates, and negotiate with confidence.

Follow The Voyager Dispatch on LinkedIn

Our weekly newsletter tracks global dynamics shaping chartering, demurrage, and freight. Want updates delivered straight to your feed? Follow us on LinkedIn to never miss a Dispatch.